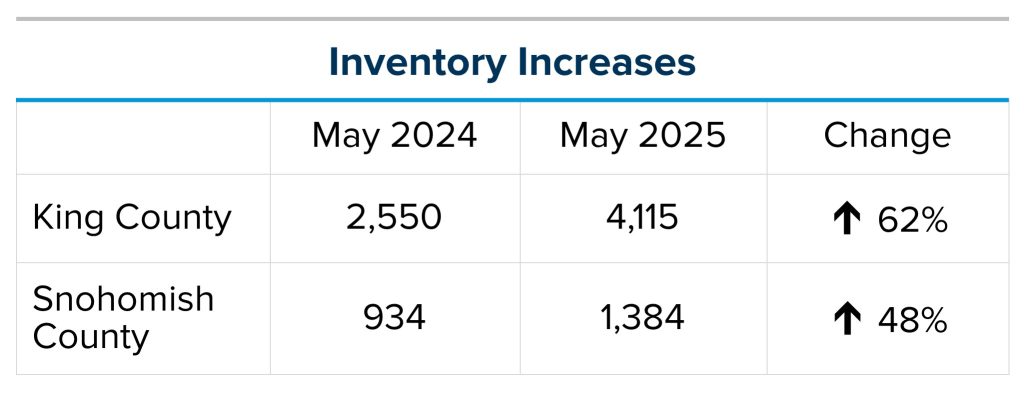

As market conditions shift and inventory increases, we are seeing that homes brought to market with sound property maintenance and thoughtful improvements are selling the fastest and yielding the highest returns. Inventory is up 62% year-over-year in King County and 48% in Snohomish County, highlighting the importance of standing out amongst the crowd. With interest rates remaining stubborn, monthly payments are buyers’ biggest concern, and many do not have the funds to make necessary repairs and improvements after a purchase. Eliminating property condition hurdles and even making modern improvements before listing the home is key to a seller’s success in getting their home sold!

Hurdles that we often encounter, which can adversely affect a home’s marketability, include deferred maintenance such as paint, carpet, and system improvements to HVAC, electrical, and plumbing systems. If a house needs a new roof or another central system replaced, this helps mitigate the upfront out-of-pocket expense. We have also seen sellers remodel and update areas of the house, such as the kitchen and bathrooms, to modernize and appeal to a broader audience. Exterior landscaping and junk hauling are also areas that help properly prepare a home for the market. A seller-procured pre-listing inspection often guides these improvements.

This is why Windermere offers two exclusive loan tools to provide sellers with access to funds based on their equity, helping them prepare their properties for today’s market. This approach is more efficient than wading through the red tape and longer timeframe associated with opening a Home Equity Line of Credit (HELOC). The Windermere Ready Loan Program now has two loan programs.

The first program ranges up to $50,000, and the second one ranges from $50,001 to $100,000. Funds for the first program can be available to the homeowner as soon as the same day the application is processed (within minutes), and the second program loans are funded within 10 days of application approval. Approval for both loans are based on the homeowner’s credit score rating and the Windermere broker’s approval of the home’s market value to establish equity within the required loan-to-value ratios. There is no need for an appraisal; both programs provide home sellers quick and easy access to funds via a loan against their equity. Then they can get to work preparing their homes for sale to attract the largest possible buyer audience.

The home equity serves as the basis for these loans, so it does not require employment verification, making this an excellent option for retirees or sellers in a job transition. Over 50% of all homeowners in the US have equity of 50% or more, making this tool the perfect solution to help would-be home sellers prepare their homes for the market and appeal to as many buyers as possible. Plus, there are no up-front costs; the loan fee and accrued interest are paid off at closing.

So, how do these programs work? First things first, contact me, your Windermere broker, as these programs are exclusive to Windermere brokers and their clients. We can evaluate which areas of improvement will yield the greatest return based on market data and trends, establish a budget with bids from my trusted vendors, and devise a winning strategy.

In the meantime, if you want to learn more about how home improvements can help maintain and enhance a home’s value, check out the 2025 Remodeling Impact Report from NAR. This will provide valuable insight. As always, my goal is to help keep my clients up-to-date on the latest trends and empower them to make informed decisions.

My office just had our annual Community Service Day, where we worked with the Snohomish Garden Club, prepping, planting, and working hard to help make sure our local food banks will get thousands of pounds of fresh produce for our neighbors in need.

This is just a piece of the larger puzzle of Windermere’s commitment to community, and my office’s commitment to take on local projects.

Thank you for choosing Windermere and helping make all of this possible!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link