As 2024 starts to come to a close, I want to spend some time talking about first-time homebuyers. Even if you already own a home, this is an important message to share; it can change someone’s life! In 2023, according to the National Association of Realtors (NAR) 2023 Profile of Home Buyers and Sellers, first-time home buyers represented 24% of the market share, which was down from 32% in 2022. First-time homebuyers are a critical part of the real estate market cycle, and we need to empower this group to invest in their future. They are also the audience that purchases inventory, enabling sellers to move on to their next home, which creates a domino effect as it travels up the market.

Often, first-time homebuyers purchase entry-level properties such as condos, townhomes, or smaller single-family residential homes based on affordability. It is also important to note that a buyer does not need a 20% down payment to purchase a home. In fact, according to NAR, the typical down payment for a first-time homebuyer in 2023 was 8%. There are loan programs that only require 3% down payments and even assistance programs requiring zero down. It is important to explore options so one knows their opportunity potential. For example, lenders will often advise borrowers to focus on saving vs. paying down debt in order to better qualify for a loan.

Sometimes, first-time homebuyers are able to skip that first level of home ownership and purchase a home that they plan to be in for many years, yet that is rare. I have found that it is critical that first-time homebuyers are focused on what monthly payment they feel comfortable taking on and commit to shopping at that price point. They then apply that price point to a combination of location, property type, and the condition/features they can afford.

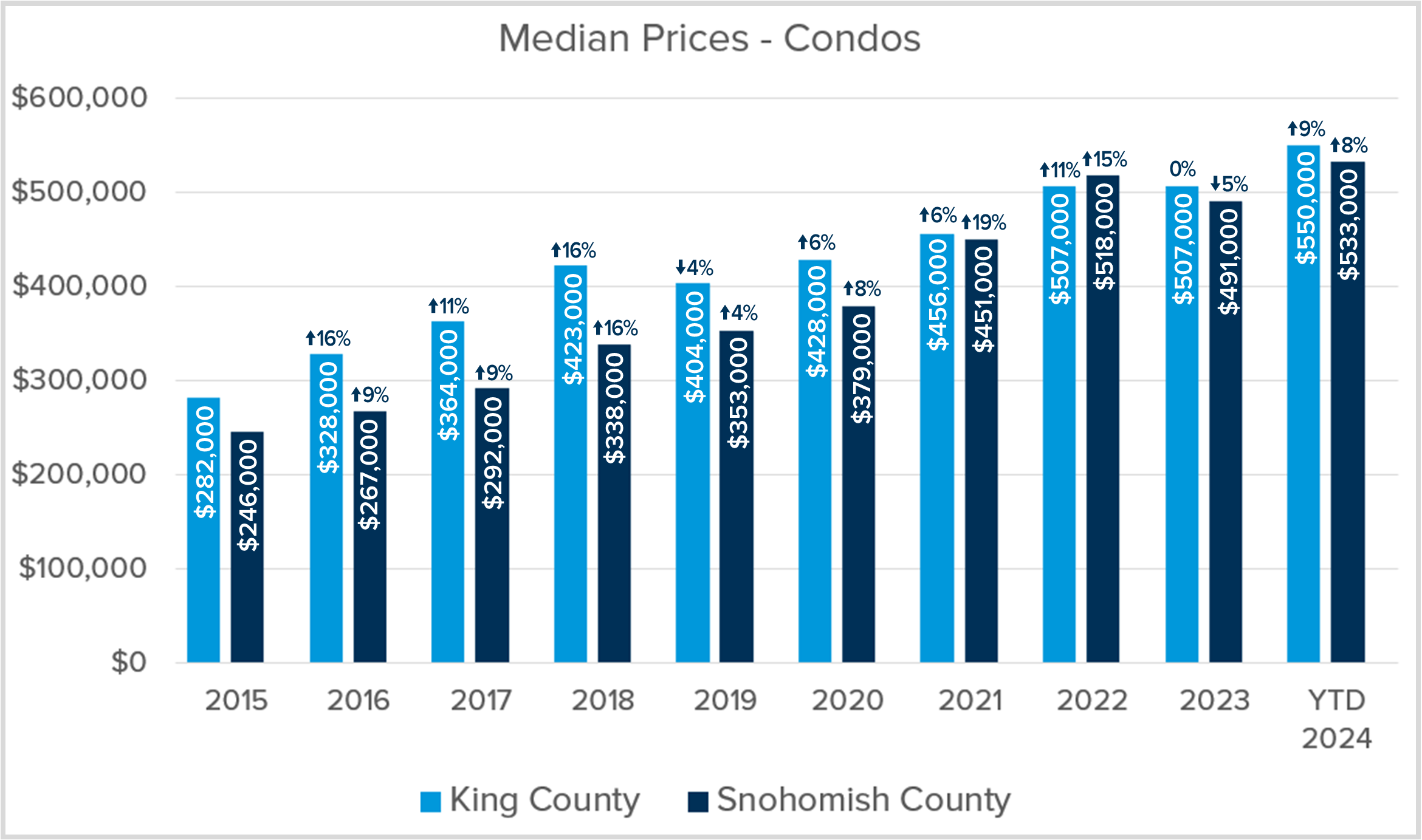

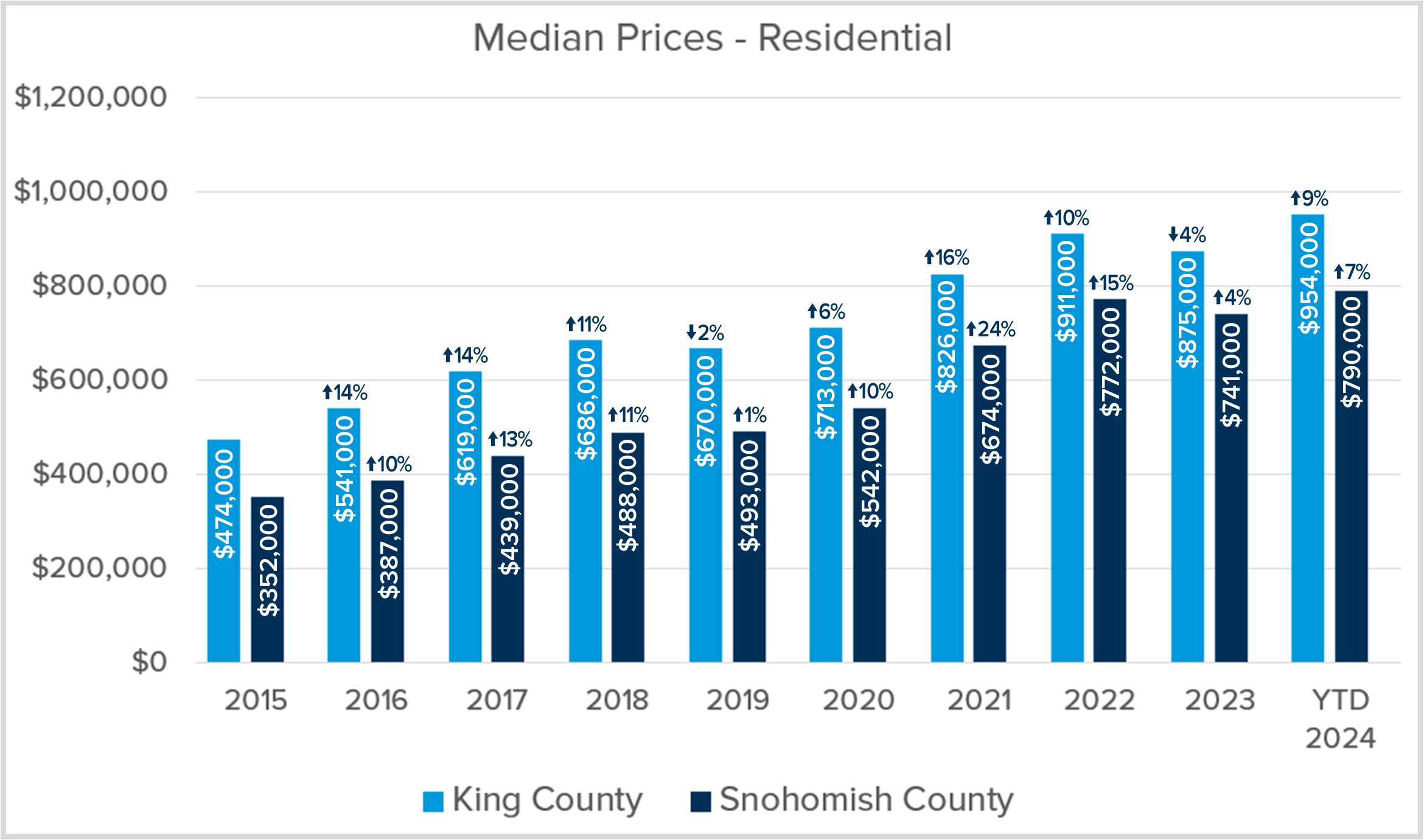

The primary benefit of ditching the rent payment and becoming a first-time homebuyer is getting on the trajectory of building household wealth. As you can see from the charts below, real estate has appreciated in both King and Snohomish counties over the last 10 years, whether it be a condo or a single-family residential property. This appreciation becomes a nest egg of savings for the homeowner over time.

For example, if you use the data from the Snohomish County Condo chart, a first-time homebuyer who bought a condo in 2020, the median price in the market was $379,000. That is now $533,000, which is a 41% gain. Granted, these are raw numbers and represent a 30,000-foot view of the market, which illustrates the trends. We can’t simply apply the percentage growth in the market overall; we would analyze comparable properties in the specific area of the subject property to find the accurate value. The appreciation trend, however, shows that the first-time homebuyer who bought in 2020 is now sitting on a healthy nest egg of savings to utilize to purchase their next home if they desire a different property based on life changes. Plus, there is no other investment vehicle that allows tax-free capital gains up to $500,000.

I point this out because I often encounter would-be first-time homebuyers who call off their search because they cannot afford the type of home or area they want, and continue to rent in the hopes of saving more to afford what they want later. While I would never want anyone to buy a home they don’t want, I do encourage my clients to consider what they can compromise on in order to start building wealth through homeownership sooner rather than later. Even if you apply the home appreciation for condos in Snohomish County prior to the pandemic, the median price in 2015 was $246,000, and four years later, it was $353,000, which is a 44% gain. Most people would not be able to save that much over that period of time, hence the advantage of building wealth via homeownership.

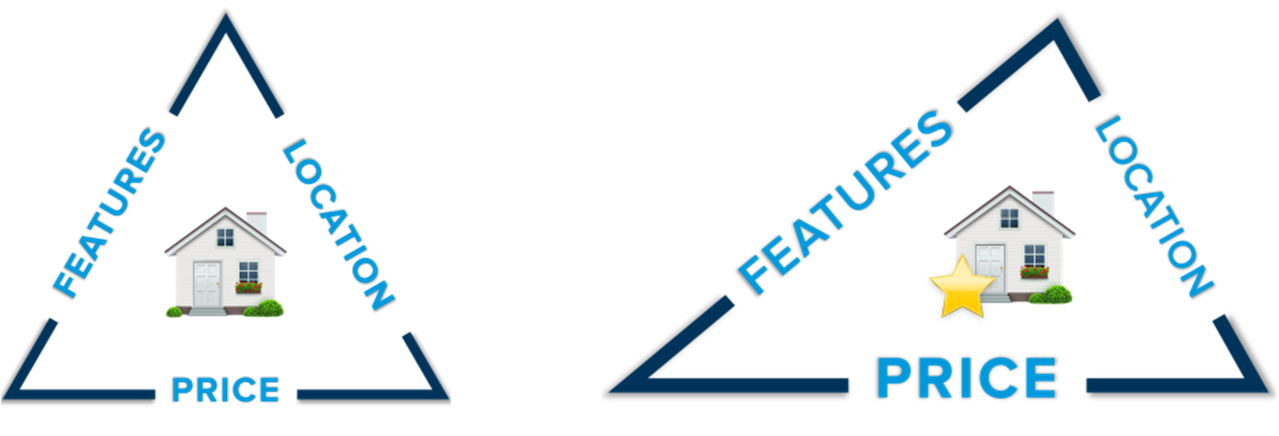

An exercise I often use with my buyer clients is applying the Triangle of Buyer Clarity to their budget and search. I am the first person to say that shopping for a home is exciting and even romantic, which results in starry eyes focused on dream homes and HGTV lore. I find that the quicker a buyer is able to put the dreaming part aside and get to the brass tacks of the market, the quicker they succeed in a purchase. Monthly payment is the single most important element to focus on to bring clarity to a buyer’s search. This figure should direct the price range for a buyer, which will determine which location, condition/features, and property type they can afford.

As you can see from the example of the Triangle of Buyer Clarity, buyers often have to adapt their search to meet their budget needs; it is rarely the perfect balance of an equilateral triangle. That could mean adapting by buying a townhome instead of a single-family home, going to a location that is a little further out, or being OK with a 90’s kitchen instead of a perfectly modern masterpiece. Getting into the market is more important than finding the perfect fit. The good news is that market trends show that townhomes, all locations throughout each county, and even 90’s kitchens appreciate! One could even tap into their equity down the road once it is built up and remodel that 90’s kitchen.

Homeownership provides many benefits. Wealth-building opportunities are huge because we all need a place to live, so why not pay your own mortgage and gain appreciation instead of building your landlord’s portfolio? There are tax benefits, too, as you can use the interest as a write-off. Plus, you get the freedom to make your house your own and build a community where you live. You can paint the walls and dig in the dirt, and you don’t have to answer to your landlord. Overall, homeownership provides stability, freedom, and community. Helping my clients gain tangible and intangible benefits is the primary goal I work towards.

This is why I couldn’t let 2024 end without giving a shout-out to the would-be first-time homebuyers out there. My best piece of advice if you are considering buying your first home is to come up with a plan. I offer all of my clients a buyer consultation meeting where we review the market trends, apply their goals and search criteria, get them connected with a reputable lender, and devise a custom plan for them. The plan could start right away or sometime in the future; what matters is working towards the goal.

My mission is to help people gain the benefits of homeownership when they are ready. When I hand off the keys to a first-time homebuyer, it is one of the most rewarding aspects of my job because I know we have changed their lives for the better. If you are a potential first-time buyer or know someone who is, please reach out, I’d be honored to help.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link